Section 80D - Medical Insurance Premium, Tax Benefit.

Section 80D

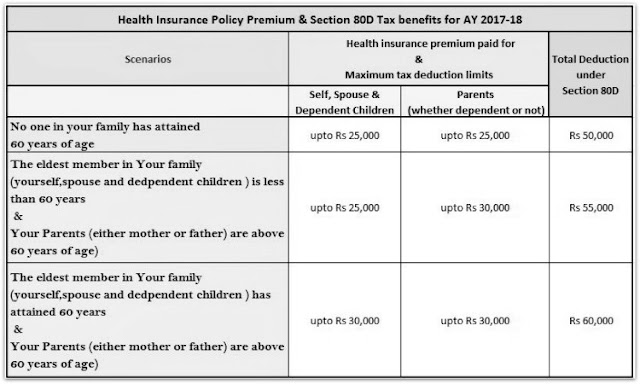

Deduction u/s 80D on health insurance premium is Rs 25,000. For Senior Citizens it is Rs 30,000. For very senior citizen above the age of 80 years who are not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above. (Family includes: Self, spouse, dependent children and parents).

Yeah, the life insurance is one of common investments in portfolio. In fact everyone should analyze everything carefully while creating portfolio. In my opinion, Risk Profiling should also be a main concern when making your investment decisions.

ReplyDelete